Achieving quick results from integration efforts is one of the most critical factors for realizing value from your acquisition strategy. In creating an investment thesis, much focus is applied during the process to the strategic elements of the plan. This is great in that helps develop an over-arching business imperative and sets a roadmap for long-term value creation. But quite often the gap between strategic intent and execution causes unmet expectations. According to Harvard Business Review, more than 70% of M&A deals fail to deliver their intended results.

While M&A remains inherently risky, leaders can employ a handful of tactics to dramatically enhance the outcomes from these efforts. From our experience over time across a number of deals, we’ve found companies that commit to achieving results quickly – within 100 days of deal close – are significantly more likely to realize the intended acquisition benefits.

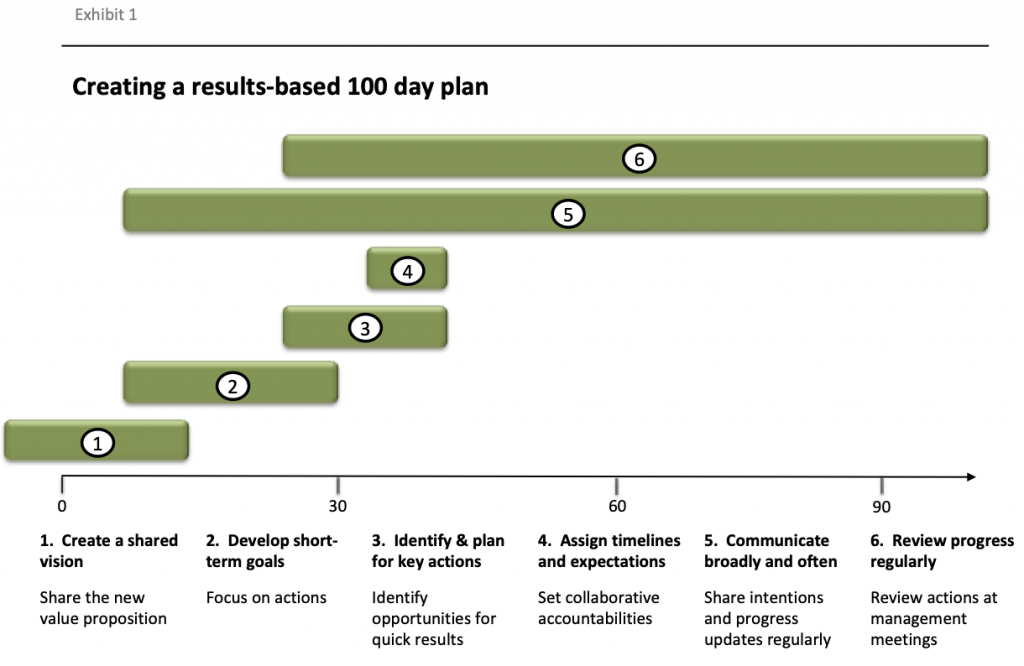

Deal champions can embrace a simple six-step process to increase their odds of realizing successful outcomes. The process serves as a bridge between corporate strategy and tactics, providing a mechanism for turning concepts into actions leading to desired results.

Leaders of successful acquisitions start by developing a shared vision of what the combined organization will be and what it will accomplish. These leaders gather input from key constituents by listening to those closest to the action, and quickly translate this information into a shared imperative. As shown in Step 1 of the exhibit below, this process should begin before the deal is closed. This allows the team to get a head start on driving toward needed results.

Once the vision has been crafted and shared, Step 2 is to identify the core group of cross-business resources who will create a small set of short-term goals. The team should include key stakeholders to ensure buy-in, though should be limited in the number of participants to avoid their efforts becoming unruly and inefficient. Participants will represent the broader groups’ interests, and they’ll be able to get input from others along the way to solidify the base of support. The goals, while only a start, must be directionally tied to the long-term enterprise objectives. The effort should be collaborative, meaning that project participants from both the acquiring and the acquired companies need to be incented to work together in partnership to achieve the intended results. The small set of goals established should each have three attributes – they must be quantifiable, actionable, and all tied to the initiative’s overall objectives. Momentum for longer-term success will be built upon a foundation of early wins, so execution of these is critical.

Since timing is important, the team must quickly translate the goals into a set of prioritized actions during Step 3 that will directly lead to expected outcomes. A simple project plan can be created to include the specific efforts required along with a timeline and owner for each of these (Step 4). In order to maintain momentum, both of these steps can naturally begin before the previous step has been completed.

A standard project plan can be used for completing the work involved with integrating multiple businesses. For acquisitions, though, you’ll want to make sure the team communicates about progress, plans and issues (Step 5) on a more regular basis than typically done with normal inter-business (product, function, process, etc.) projects. Overall communication efforts should actually begin as soon as possible, ideally in line with the creation of the shared vision. This will increase buy-in across the combined enterprise, and will provide regular opportunities to receive feedback and incorporate adjustments.

Leadership must make the review of these critical actions a priority, by adding progress updates (Step 6) to its regularly recurring review meetings. These reviews should happen no less than every other week, and – depending on priority and timing of the action – may be appropriate to occur every week. To increase initiative outcomes, the reviews can begin informally even before project specifics have been defined.

By following a proven approach to acquisition integration that includes setting a clear vision with specific goals, actions and timelines, monitoring progress regularly, and communicating to all constituents throughout the process, enterprise leaders can dramatically increase the probability of achieving successful outcomes.